Home

Salary After Taxes Nyc . New york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers' income level and filing status. Overview of new york taxes.

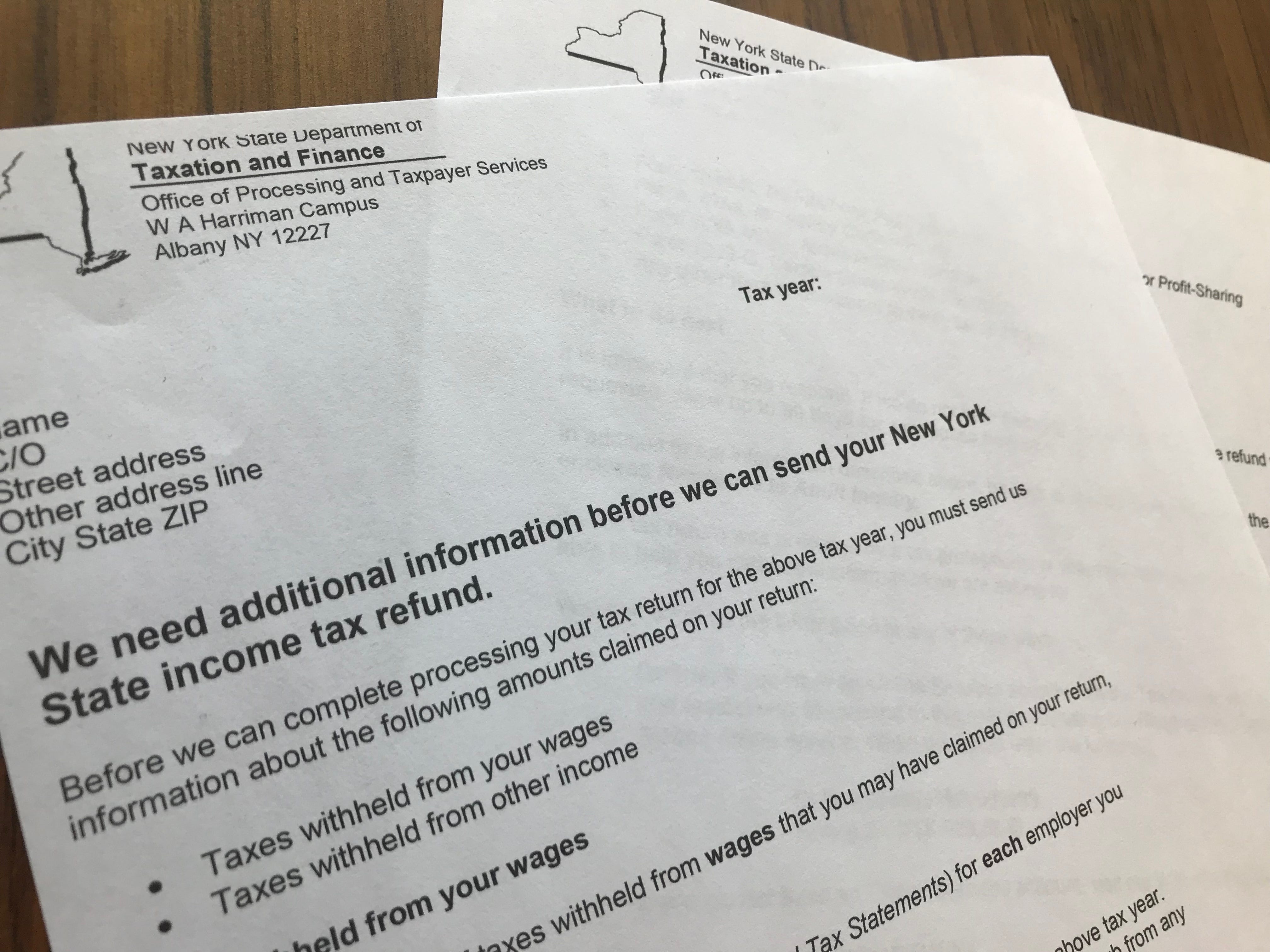

Get An Nys Tax Dept Letter Don T Throw It Out Or You Might Delay Your Refund from www.gannett-cdn.com However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020). It's not cheap to live in ny. The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. Supports hourly & salary income and multiple pay frequencies. New york state and city income tax.

New york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers' income level and filing status. Gross pay for w2 or salaried employees after federal and state taxes. Nyc imposes an additional 3.648% tax on income over $50,000. The average emt salary in new york is $39,320 as of april 27, 2021, but the range typically falls between $35,230 and $44,390. This results in roughly $24,337 of your earnings being taxed in total, although depending on your situation there may be some other smaller taxes added on. New york $120,000.00 salary example this $120,000.00 salary example for new york is based on a single filer with an annual salary of $120,000.00 filing their 2021 tax return in new york in 2021. Filing $120,000.00 of earnings will result in $6,563.68 of your earnings being taxed as state tax (calculation based on 2021 new york state tax tables).

Source: img.youtube.com One of a suite of free online calculators provided by the team at icalculator™. Below are your new york salary paycheck results. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.

The united states' economy is the largest and one of the most open economies in the world, representing approximately 22% of the gross world product. The state as a whole has a progressive income tax that ranges from 4.00% to 8.82%, depending on an employee's income level. Your average tax rate is 25.9% and your marginal tax rate is 35.7%.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. New york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers' income level and filing status. Check out our new page tax change to find out how federal or state tax changes affect your take home pay.

Source: cdn.howmuch.net For 2k a month, you will end up with a studio apartment either in the outskirts queens, brooklyn or way uptown past the park. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020).

Nyc imposes an additional 3.648% tax on income over $50,000. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. If you're lucky enough to work somewhere that doesn't require you to pay part of your m.

Your average tax rate is 25.9% and your marginal tax rate is 35.7%. That means that your net pay will be $55,560 per year, or $4,630 per month. Calculating taxes in new york is a little trickier than in other states.

Source: www.tax.ny.gov Overview of new york taxes. The average monthly net salary in the united states is around 2 730 usd, with a minimum income of 1 120 usd per month. Your average tax rate is 25.9% and your marginal tax rate is 35.7%.

Check out our new page tax change to find out how federal or state tax changes affect your take home pay. The united states' economy is the largest and one of the most open economies in the world, representing approximately 22% of the gross world product. This calculator is intended for use by u.s.

The average emt salary in new york is $39,320 as of april 27, 2021, but the range typically falls between $35,230 and $44,390. Nyc imposes an additional 3.648% tax on income over $50,000. 365 days in the year* (*please use 366 for leap years) formula:

Source: www.thebalance.com Living in new york city adds more of a strain on your paycheck than living in the rest of the state, as the big apple imposes its own local income tax on top of the state one. 6.2% of each of your paychecks is withheld for social security taxes and your employer contributes a further 6.2%. If an employee has requested a voluntary deduction for tax withholding, no problem—you can include that info too.

Filing $90,000.00 of earnings will result in $4,664.68 of your earnings being taxed as state tax (calculation based on 2021 new york state tax tables). If an employee has requested a voluntary deduction for tax withholding, no problem—you can include that info too. That means that your net pay will be $42,787 per year, or $3,566 per month.

Use it to estimate net vs. Supports hourly & salary income and multiple pay frequencies. Calculating taxes in new york is a little trickier than in other states.

Source: assets.bwbx.io Are you paying any portion of your medical insurance? Supports hourly & salary income and multiple pay frequencies. If an employee has requested a voluntary deduction for tax withholding, no problem—you can include that info too.

It is not a substitute for the advice of an accountant or other tax professional. This results in roughly $24,337 of your earnings being taxed in total, although depending on your situation there may be some other smaller taxes added on. The $ 60,000.00 new york tax example uses standard assumptions for the tax calculation.

This calculator is intended for use by u.s. Your average tax rate is 22.2% and your marginal tax rate is 36.1%. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Source: incomeaftertax.com If you make $75,000 a year living in the region of new york, usa, you will be taxed $19,440. This places us on the 4th place out of 72 countries in the international labour organisation statistics for 2012. Fica contributions are shared between the employee and the employer.

This results in roughly $24,337 of your earnings being taxed in total, although depending on your situation there may be some other smaller taxes added on. This results in roughly $35,553 of your earnings being taxed in total, although depending on your situation there may be some other smaller taxes added on. Nyc entry salary after taxes post by underdawg » wed sep 29, 2010 7:16 am anyone who lives in ct is a miser or is whipped (or the female equivalent of being whipped).

Overview of new york taxes. However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020). By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Thank you for reading about Salary After Taxes Nyc , I hope this article is useful. For more useful information visit https://labaulecouverture.com/